Good Cap Table Hygiene

Keep Clear and Accurate Records of a Company's Ownership to Simplify the Deal Process

I wrote the following article for the Mountain West Capital Network’s Deal Flow 2024 Report. I spend a lot of time with clients trying to recreate and document their equity issuances, generally in the middle of a deal. Getting this right from the beginning can save substantial time and money when a deal is on the table.

Maintaining Your Cap Table: Be Prepared for a Deal

A properly maintained cap table ensures that companies are ready for investment, debt financing, or a sale when the time comes. Addressing issues early—before they become deal breakers—can save time, money, and stress.

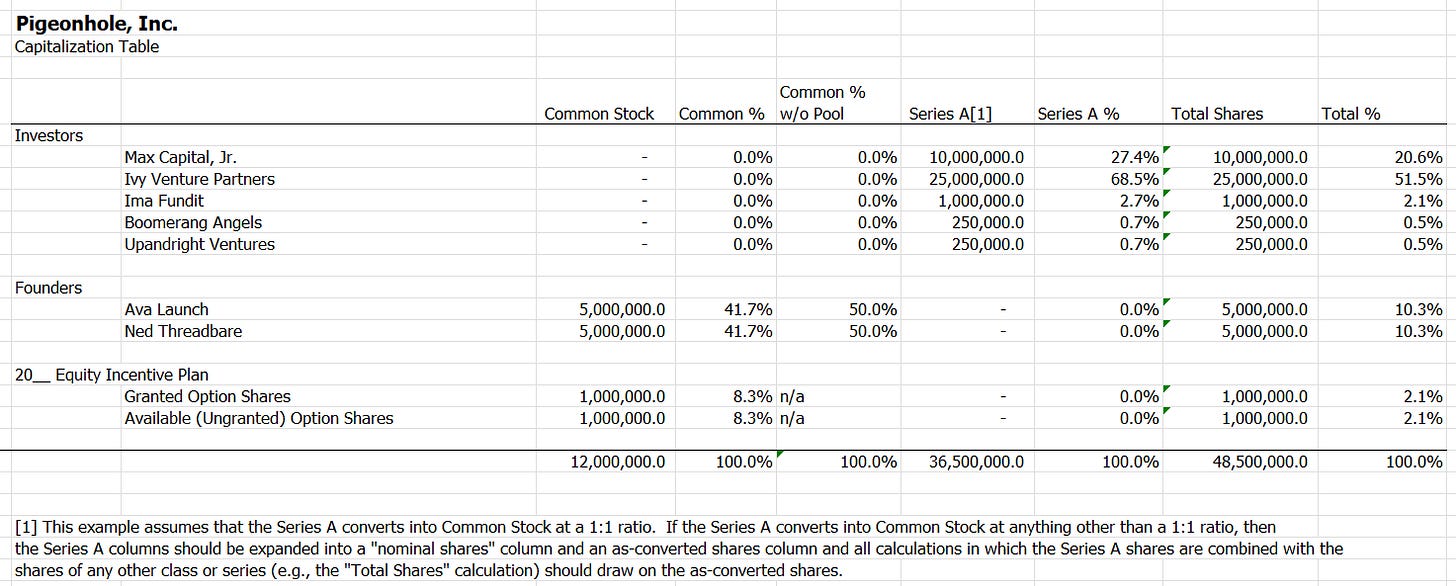

A capitalization table (or cap table) is a detailed record of a company’s ownership structure. It shows who owns what percentage of the company and lists all equity holders—such as founders, investors, and employees—along with the shares, stock options, and other securities (like convertible notes or warrants) they hold. An accurate cap table helps businesses track ownership, make informed financial decisions, and prepare for fundraising, sales, or other major transactions.

When companies raise capital, take on debt, or sell the business, their equity issuances will be scrutinized. Who owns what, what they paid for their ownership, and whether the issuance complied with legal requirements are fundamental questions that businesses must be able to answer with certainty. Ensuring that a company has properly authorized, issued, and documented its equity is not just a best practice—it is a critical factor in securing financing and closing transactions. Without proper record-keeping and compliance, uncertainty around ownership can delay or even kill a deal. Companies that fail to maintain their cap table can find themselves in a difficult position when investors, lenders, or buyers come calling to conduct their due diligence.

Best to start early; but it’s never too late

Startups and growing companies should establish good equity management practices from the outset. It is far easier to follow appropriate procedures and maintain accurate records in real time than to go back and fix mistakes later. Ensure that board approvals are documented, stock issuances are properly recorded, and the cap table is kept current. This can prevent unnecessary headaches when a company seeks funding or contemplates an acquisition.

Many companies—especially small businesses and fast-growing startups—find that their equity records are less organized than they should be. Whether due to informal early-stage agreements, inconsistent documentation, or missing approvals, capitalization issues can snowball over time. The good news is that these problems can be fixed. The earlier a company takes steps to clean up its cap table and documentation, the easier and less costly it will be.

Making the capitalization representation

In most transactions—financing rounds, stock sales, or mergers—companies are required to make a representation about their capitalization. This means they must confirm, in writing, that all of their outstanding equity has been:

duly authorized: the company has obtained all necessary corporate approvals, typically from its bord of directors and, in some cases, shareholders, before issuing shares or granting rights (such as options) to acquire shares;

validly issued: the shares were issued in compliance with applicable corporate laws, meaning the company followed the correct procedures and complied with any legal restrictions or limitations; and

nonassessable: the equity holders have no further financial obligation to the company relating to the specific securities they receive. This assurance is important because it means the equity holders themselves are not personally at risk for any financial or legal liabilities of the company beyond what they have already paid for their equity.

Breaches of this representation can expose the company to legal challenges, disputes with shareholders, and, in some cases, claims from investors or buyers who relied on incorrect information.

Gain confidence in the capital structure

Confidence that a company can make a representation that its equity is in order, comes from following these steps:

Observe corporate law requirements for equity issuances. Issuances of stock or other equity must comply with corporate formalities and securities law. Be sure to obtain proper board and shareholder approval and adhere to any limitations in your governing documents.

Create and follow equity incentive plans. Issuances of stock options, restricted stock, or other equity incentives should follow the terms of incentive plans that have been properly adopted and administered by the company. Deviations from plan terms, such as required approvals, may lead to disputes.

Maintain complete and accurate equity records. Every issuance or transfer of equity should be documented with SIGNED agreements and clear records. Missing or incomplete documentation can create uncertainty, especially during the due diligence process of a financing or a sale.

Keep the cap table accurate and updated. The cap table is the central source of truth regarding the company’s ownership structure. A well-maintained cap table should reflect all outstanding equity, including stock, options, warrants, and convertible securities (convertible notes and SAFEs).

Resources for cap table management

Managing equity records and cap tables can be complex, but there are tools available to help. Specialized cap table management software (like Carta or Shareworks) can assist with recording equity issuances, preparing appropriate documentation, and even scenario planning for future issuances. A well-maintained spreadsheet can also serve as a reliable record (templates are easily found online). And legal counsel can help.

If your company needs assistance in creating or maintain its cap table, or if you are anticipating a deal in the next few years and want to confirm that your capital structure is sound, consider seeking assistance from experienced startup and deal lawyers.

Daniel Olson, Dentons Durham Jones Pinegar

Dan is Of Counsel at Dentons, based in Salt Lake City. He is a seasoned deal lawyer with experience at large law firms and in-house with technology startups. He has been in the trenches himself as the co-founder of a medical diagnostic company and understands first-hand the struggles of the entrepreneur. Email him at: daniel.olson@dentons.com