Strategy Principles: Winning, Value Creation and Capture, and the Value Stick Framework

In Brief

Value Creation and Capture

Companies must create value (produce something worth paying for) and capture value (earn enough to cover costs).

Competition is based on the value provided, not just price.

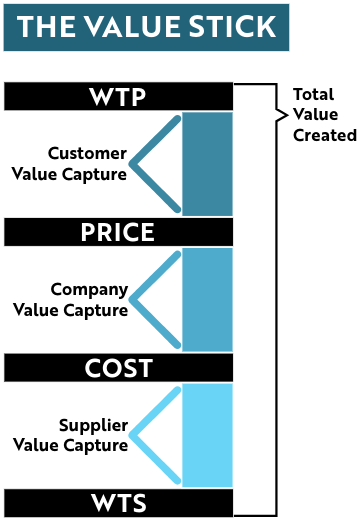

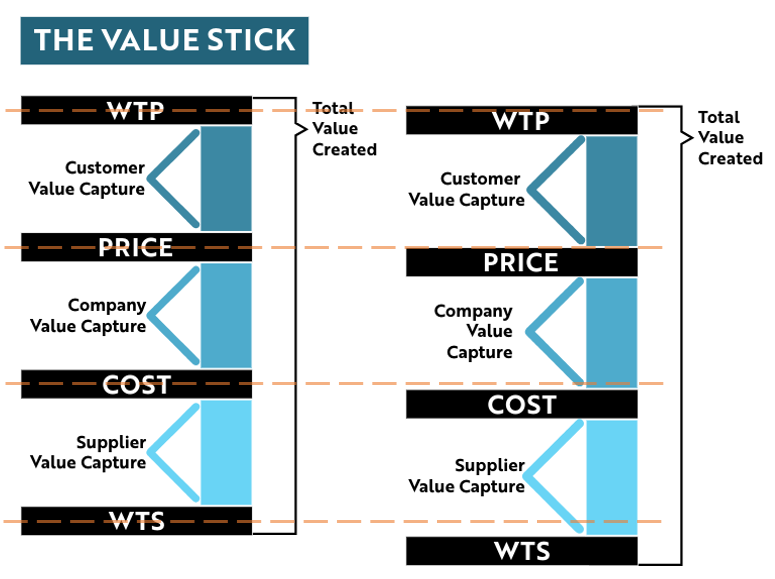

The Value Stick is a helpful framework for thinking about how value is created and who is capturing the value: customers, suppliers, or the company.

Overall value created is the difference between the customers’ willingness to pay (WTP) and the suppliers’ willingness to sell (WTS).

Customer value capture is the difference between WTP and the price.

Supplier value capture is the difference between WTS and the actual costs.

Company value capture (the company’s margin) is the difference between the price and the cost.

Strategies for Value Capture

Increase WTP through differentiation (e.g., Apple’s premium pricing due to unique product features and strong brand).

Decrease WTS by reducing supplier costs (e.g., Walmart’s efficient logistics and scale economies).

Value-Based Strategy:

Focus on creating more overall value by either increasing WTP or decreasing WTS.

Aim to increase company value capture without diminishing customer and supplier value.

Winning is Creating and Capturing Value

A company’s strategy is its theory of winning, but every company needs to decide what “winning” means to them. The answer depends on the values and goals of its key stakeholders: founders, investors, the board, management, employees, etc. To some companies, winning may mean maximizing the company’s share price, capturing customers from competitors, or dominating a certain market. To others, it may simply be generating sufficient revenues to pay employees and continue operating as a business. No matter the definition of winning, a successful company must create something that someone is willing to purchase—create value—and bring in enough to at least cover their costs—capture value. A company’s strategy is then, in essence, its theory of how it is going to create and capture value.

Competition on Value

We often hear about “price wars” between competitors, but companies don’t actually compete on price. They compete on how much value they provide.

Customer Value Capture

If products are identical, we would expect customers to purchase the one with the lowest price—not because the price is low, but because the low price allows customers to capture the most value from the purchase. If products are not identical, customers balance the features of the product with the price to determine which product provides the most value. That’s the one they purchase.

Supplier Value Capture

To produce a product, companies require inputs: raw materials, components, labor, know-how, etc. They must compete with others for those inputs. If the inputs are generic, suppliers will sell their inputs to the producer willing to pay the highest price—this provides the most value to the suppliers. If the inputs are not identical, the suppliers balance the price with other factors to determine which sale creates the most value. They will make the sale that generates the most value.

Company Value Capture

Companies are stuck between customers and suppliers. The value that companies capture is the difference between the price they charge customers and the costs they incur to produce their product.

If they raise prices without increasing costs, they increase the value they capture. But they also reduce the amount of value customers capture.

If they decrease costs without decreasing prices, they increase the value they capture. But they decrease the value suppliers capture.

If the companies are competing for customers or suppliers, the reduction in value for customers or suppliers will likely result in the company losing sales and/or the ability to get the inputs they need to create products.

The Value Stick Framework

The “Value Stick” framework, developed by Harvard Business School’s Felix Oberholzer-Gee, provides a helpful illustration of creating and capturing value and the tradeoffs inherent in balancing the two.

As presented above, the Value Stick is comprised of four main components:

Willingness to Pay (“WTP”) is the absolute maximum price customers would be willing to pay for a product.

Willingness to Sell (“WTS”) is the absolute minimum price that suppliers, including employees and anyone else whose inputs are required to make the product, would be willing to charge to provide their inputs.

Price is the actual price the company charges for the product.

Cost is the actual cost the company incurs in producing the product.

The Total Value Created by the product is represented by the distance between WTP and WTS.

Customer Value Capture is the difference between WTP and Price—customers might be willing to pay a higher price for the product but are getting it for less.

Supplier Value Capture is the difference between WTS and the Cost—suppliers/employees might be willing to produce the product for less but are benefiting by getting more.

Company Value Capture is the difference between Price and Cost and is often called the company’s margin.

The Value Stick and Company Strategy

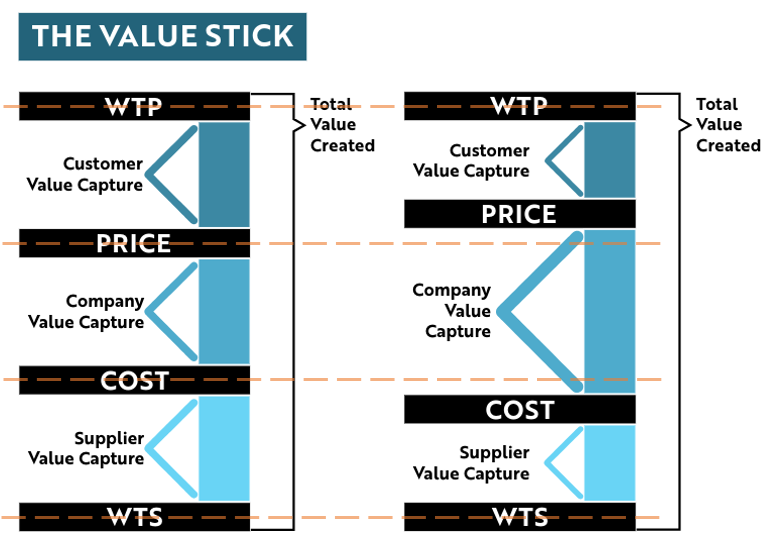

Value Capture as a Zero-Sum Game

Companies can capture more value by increasing their prices without a corresponding increase in costs. Similarly, they can capture more value by reducing costs without a corresponding reduction in prices. The Value Stick helps illustrate that simply increasing prices or lowering costs increases value capture for the company at the expense of customers or suppliers. In a competitive environment, companies may lose their customers or suppliers if they are not providing them with the same value they could get elsewhere.

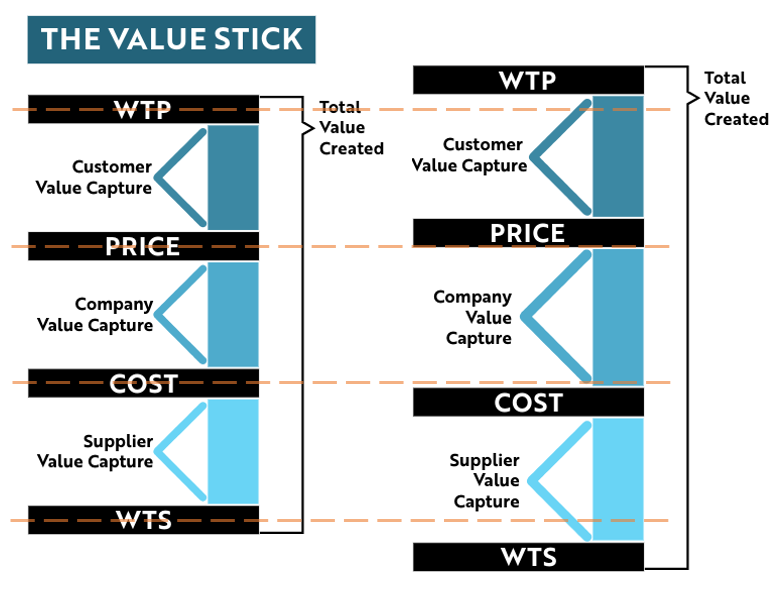

Increasing Value Capture by Increasing Value

Until now, we have been treating the overall value created by a product as static: price and costs might change, but WTP and WTS remain the same. Of course, this does not have to be the case. By increasing WTP or decreasing WTS (or both), companies create more value overall and so can increase the value they capture without reducing (and perhaps even increasing) customer and supplier value.

Increasing WTP

If a company can increase the WTP of its customers, the company can increase its price (thus capturing more value) while still allowing the customer to capture at least as much value as before. Companies can increase the WTP of their customers by differentiating: providing unique products or product features that have more value for their customers.

But the uniqueness involved in differentiation often entails an increase in costs—the cost of higher quality raw materials might be higher, the costs of research and development associated with unique features might increase, and the costs associated with marketing the unique value might be higher, etc. Nevertheless, as long as the additional costs incurred to increase WTP do not exceed the increase in price the company can charge, the company can still increase the value it captures. Providers of luxury goods are a simple example of this: the costs associated with their investments in producing quality goods and in establishing and maintaining their brands are higher than more generic alternatives, but the prices they can charge are higher than their increased costs so they capture more value per product sold.

For example, through innovative product design, high-quality materials, and a strong branding Apple is able to charge premium prices for its products. Despite the higher costs, Apple's ability to command higher prices results in significant value capture.

Increasing WTP by providing unique value is the foundation of a Differentiation Strategy, one of Michael Porter’s generic business-level strategies (more about these to come in future posts).

Decreasing WTS

If a company decreases the WTS of suppliers, the company can reduce its costs (thus capturing more value) while still allowing suppliers to capture at least as much value as before. Recall that in this post I am using the term “suppliers” to refer to anyone whose inputs are required to produce and deliver the product. This includes the company’s own employees, suppliers of raw materials or component parts, product distributors, etc.

Decreasing WTS of suppliers can happen in many ways. Some examples include:

Providing employees with valuable non-pecuniary benefits so they provide services for lower wages;

Providing training and other resources to help employees become more efficient and move up the learning curve quickly;

Using lower-cost raw materials;

Making investments in production processes or technologies that increase efficiency;

Providing suppliers with long-term contracts or bulk orders in return for a reduction in prices; or

Reducing expenditures on marketing campaigns or on establishing the product’s brand.

Many of the strategies that companies use to decrease WTS to lower costs also result in company’s having to reduce the price in order to provide customers with sufficient value. For example, lower-cost raw materials may lead to lower-quality products and, therefore, to a lower WTP and a corresponding decrease in price. As long as the reduction in price is less than the reduction in cost, this strategy still results in an increase in value capture for the company.

Walmart is an example of a company that focuses on lowering its costs. By leveraging its massive scale to negotiate lower prices with suppliers, investing in efficient logistics, and maintaining a lean operational structure, Walmart has lower costs than many competitors and can offer low prices to customers while still capturing significant value.

Decreasing WTP in order to obtain lower costs is the basis for a Cost Leadership Strategy, another of Michael Porter’s generic business-level strategies.

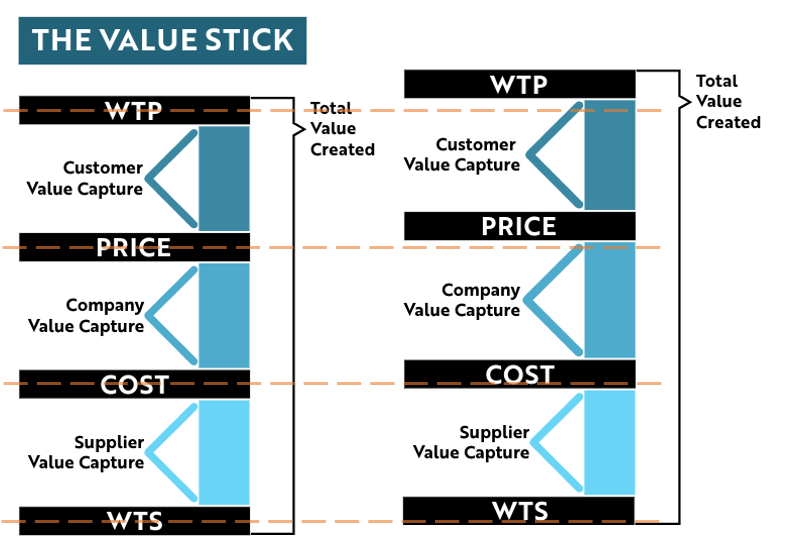

The Value Stick and a Value-Based Strategy

The Value Stick framework can help companies think about how they compete on value: how they are creating and who is capturing that value. With a focus on increasing the amount of value a company creates, by either increasing WTP or decreasing WTS, or maybe both, companies can increase the amount of value they capture but not at the expense of the value they provide to their customers and suppliers.

How does your company create value? Who is capturing that value? How can your company innovate in order to increase the amount of value the company captures as well as the amount of value your customers and suppliers capture?

Helping Your Company Create and Capture Value

As the largest law firm in the world, Dentons can help your company grow, protect, operate, and finance your organization by providing uniquely global and deeply local legal solutions in line with your company’s approach to creating and capturing value. For more information, contact Daniel Olson at daniel.olson@dentons.com.